tax break refund tracker

Lets break down the refund schedule and how long it takes for the IRS to issue refunds. Tracing a Refund Check Thats Gone Missing.

Where S My State Tax Refund Updated For 2021 Smartasset Tax Refund Income Tax Deadline Filing Taxes

This is only applicable only if the two of you made at least 10200 off of unemployment checks.

. Otherwise the refund will be mailed as a paper check to the address the IRS has on hand. The Wheres My Refund. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

IRS TAX REFUND. The best tax break of all is being able to entirely eliminate certain types of income from your tax return. TOP will deduct 1000 from your tax refund and send it to the correct government agency.

Check Your Refund Status Online in English or Spanish Wheres My Refund. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. Taxpayers got a surprising tax break relating to unemployment benefits received in 2020 only as part of a.

You were going to receive a 1500 federal tax refund. How to claim an unemployment tax refund and how to check the IRS payment status The American Rescue Plan provided a significant tax break for those who received unemployment. Tax Break Tracker is a database on governmental tax abatement disclosures.

WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. The tool tracks your refunds progress through 3 stages. Whether you save it for retirement use it to pay down credit card debt or spend it immediately a tax refund can be a great financial boost.

How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid. You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund. Includes a tracker that displays progress through three stages.

Many Americans depend on their tax refund as an important part of their annual budget. Your Social Security number or Individual Taxpayer Identification. The IRS receives the tax return then approves the refund and sends the refund.

Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. Taxpayers can start checking on the status of their return within 24 hours after the IRS received their e-filed return or four weeks after they mail a paper return. Generally these types of tax breaks apply to specific taxpayers.

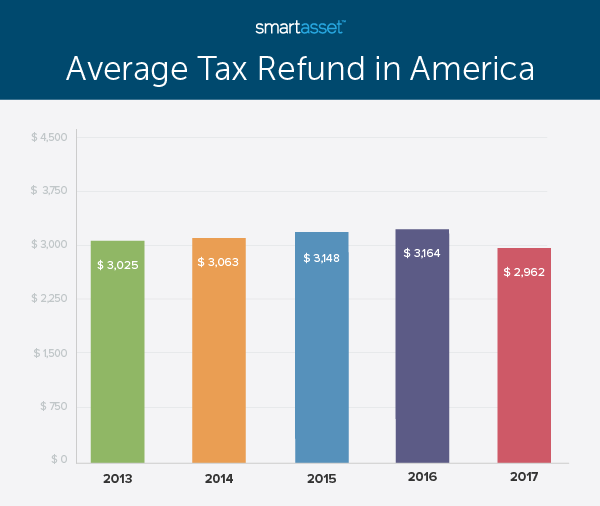

The average refund so far this year is 3401 which is a 137. If you want to estimate how big your refund will be this year youll be well served by our free tax return calculator. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information.

To check the status of your 2020 income tax refund using the IRS tracker. Check For the Latest Updates and Resources Throughout The Tax Season. Theres a process in place in case you lose your paper check or if it goes missing.

TAX SEASON 2021. If you submit your tax return electronically you can check the status of your refund within 24 hours. Your Social Security number or Individual Taxpayer Identification.

CINCINNATI WKRC - Those who welcomed a new baby to their family in 2021 could qualify to receive up to 5000 on their tax refund this year. Learn more about our work in this area here. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information.

The first and only of its kind this database contains information on the fiscal cost of economic development tax incentive programs as reported by state and local governments in their comprehensive annual financial reports or. Compensation as income are eligible for a tax break and could get a hefty sum of. Wheres My Tax Refund a step-by-step guide on how to find the status of your IRS or state tax refund.

When Will I Get My Tax Refund. The IRS is doing the recalculations in two phases starting with those who are eligible for the up to 10200 tax break. The IRS will determine whether the check was cashed.

Basically you multiply the 10200 by 2 and then apply the rate. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. For the latest information on IRS refund processing see the IRS Operations Status page.

Any people in the United States will have already been sorting their 2021 tax return but there are some citizens who are still waiting for their 2020 tax refund. Heres an example. Tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app.

Return Received Refund Approved Refund Sent You get personalized refund information based on the processing of your tax return. Luckily the millions of people who are getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law can track their refund with this IRS tool. Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return.

- One of IRSs most popular online features-gives you information about your federal income tax refund. See refund delivery timelines and find out. Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next.

Is the best way to track tax refund with IRS Wheres My Refund tool. But you are delinquent on a student loan and have 1000 outstanding. As of March 4 most recent data available nearly 38 million tax refunds worth more than 129 billion have been issued in 2022.

One example is the potential to exclude most if not all of your Social Security income from income taxation during your retirement years. Use TurboTax IRS and state resources to track your tax refund check return status and learn about common delays. This is due to two tax credits in the 19 trillion aid package President Joe Biden signed into law in 2021.

Another way is to check your tax transcript if you have an online account with the IRS. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. IRS unemployment refund update.

Stay Organized And Tax Ready With The Itemized Medical Expense Worksheets The Medical Expens Medical Expense Tracker Expense Tracker Printable Expense Tracker

Income Tax Refund Status Check Income Tax Refund Status Online Income Tax Tax Refund Income Tax Return

Income Tax Return E Filing E Filing Income Tax Returns Trutax Income Tax Return Tax Return Income Tax

Pin By Vann Ferguson On Finances In 2022 Tax Refund Income Tax Return Child Tax Credit

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Time To File Your Taxes And Get Your Refund Check Check Out These Great Options For Filing Your Taxes Free And Ideas Tax Refund Finance Debt Tax Deductions

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

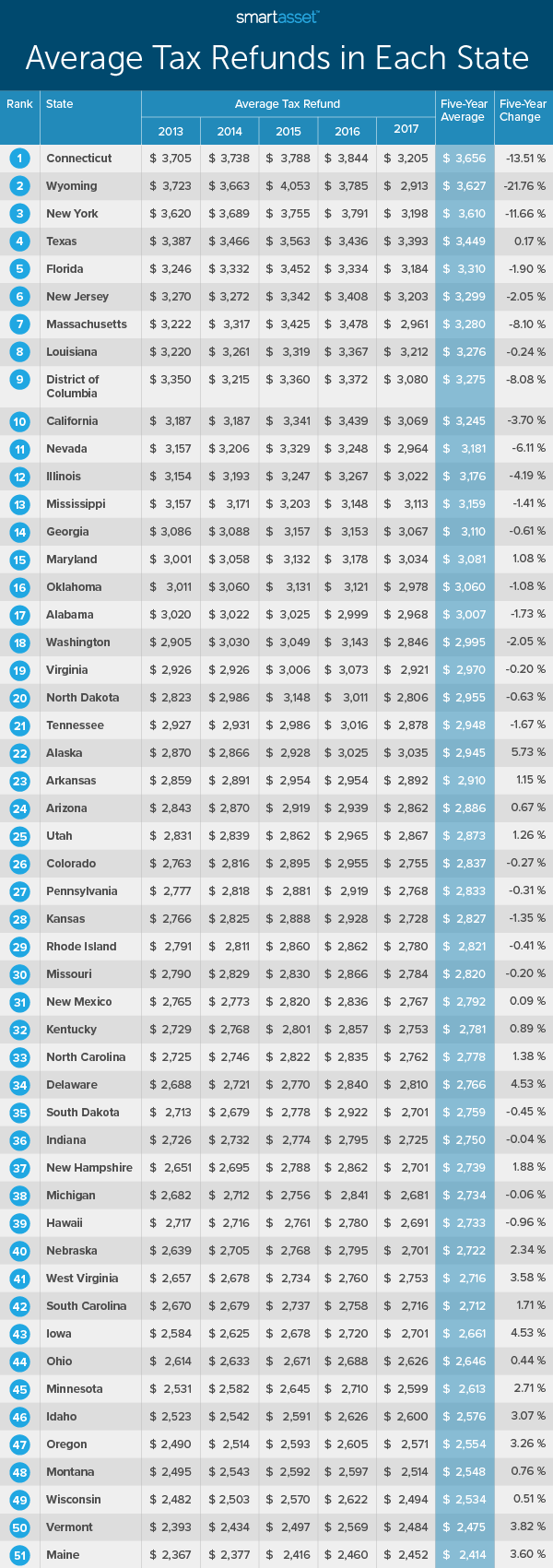

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Irsnews On Twitter Tax Refund Tax Time Tax Help

Where S My Refund How To Track Your Tax Refund 2022 Money

How To Find Out Your Tax Refund Status Tax Refund Irs Taxes Tax

Company Registration For Startup Startup India E Filing Services On Trutax Income Tax Tax Return Income Tax Return

Tds Refund How To Claim Check Status Of Tds Refund Coding Hsn Tax Refund

Tax Refunds 8 Reasons Why Your Irs Money Could Arrive Later Than Expected Cnet

Why Tax Refund Is Important For Everyone Income Tax Return Tax Refund Income Tax

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Get Tax Refund Status For Taxreturn2021 El Paso Tx Tax Refund Tax Return Tax

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset